What Would Rescheduling Mean for Cannabis?

The American cannabis industry faced a groundbreaking development in August of 2023 when the Department of Health and Human Services (HHS) asked the DEA to reschedule marijuana as a Schedule III substance. What happens next?

HHS Announcement, Followed by SAFE Prioritization, Gives Businesses and Investors Hope

The change would loosen federal regulations that have hampered the industry for years due to marijuana’s current Schedule I status under the Controlled Substances Act.

This unprecedented development instilled confidence in investors and industry operators alike, causing cannabis stocks to skyrocket for the first time since 2021.

And just last week, this optimism was bolstered further by the announcement that the Senate may soon pass the SAFE Banking Act, which would protect institutions offering financial services to cannabis businesses from federal penalties and regulatory backlash. Without the SAFE Act, these risks that have driven companies such as Mastercard to cut ties with the industry, leaving businesses scrambling to secure basic banking and payment solutions. News that the SAFE Act will soon pass the Senate continued to fuel investors’ confidence, as stocks steadily rose into Monday morning after years of depression and decline.

Even though the DEA has yet to finalize the rescheduling decision, the HHS’s recommendation is groundbreaking and extremely promising for the future of cannabis in the United States: Vince Sliowski, Oregon-based cannabis attorney, called the motion “paradigm shifting…I can’t emphasize enough how big of news it is.”

These decisions would have groundbreaking implications for the future of cannabis businesses, stocks, and medical research. If cannabis is rescheduled and the SAFE Act passes, the government would effectively lift barriers that have been halting the industry’s progress since its inception, allowing stocks to soar and the industry to thrive.

But how would rescheduling change the U.S. cannabis landscape for patients, business owners, investors, and the industry at large? Read on to learn more about what rescheduling would mean for America’s cannabis industry and consumers.

What Would Schedule III Mean for U.S. Regulated Marijuana?

The rescheduling development was facilitated in 2022, when President Joe Biden requested that both the HHS and DEA attorney general reconsider marijuana classification, in support of legalizing cannabis use “where appropriate” and in a manner “consistent with medical and scientific evidence.” And late last month, the HHS delivered its decision in a memo to the DEA recommending the rescheduling of cannabis at the federal level.

Now, the decision to reschedule is in the hands of the Drug Enforcement Administration, which will subject the proposal to a standard review process before determining whether to put it into effect.

If the HHS recommendation is approved, marijuana will move from Schedule I to Schedule III under the Controlled Substances Act (CSA), which categorizes and regulates drugs by Schedules I-V at the federal level. The CSA was enacted during the War on Drugs era to regulate, control, and penalize possession or use of various drugs to provide frameworks for doctors and law enforcement nationwide.

At Schedule I, marijuana is currently categorized alongside cocaine, heroin, and other drugs that are treated as having a “high abuse potential” with “no accepted medical use,” despite the fact that cannabis has been legalized in two-thirds of the country since the CSA was enacted. This outdated classification of cannabis has clearly become obsolete at the state level, but because cannabis remains federally illegal, its Schedule I status has created countless difficulties for legitimate cannabis businesses, while preventing access to basic banking services and tax deductions due to federal and regulatory scrutiny.

If cannabis is moved to Schedule III, it will be classified alongside other drugs–such as prescription ketamine (Spravato), anabolic steroids, and certain barbiturates–with low abuse potential and accepted medical uses.

This class of drugs is far less strictly regulated, and would relax restrictions that have hampered the industry and its consumers by limiting access to banking, raising taxes, and imposing various other challenges that the industry has faced since its inception.

Rescheduling and Elimination of IRS 280E

One major benefit that would emerge from cannabis’ rescheduling is the elimination of IRS 280E taxation. IRS 280E prohibits cannabis operators from deducting otherwise ordinary business expenses from income associated with the “trafficking” of Schedule I or Schedule II substances.

Under IRS 280E, cannabis businesses are prohibited from deducting ordinary expenses granted to virtually all other business types, which, combined with excessive sales taxes upfront–which in some states have reached nearly 40%–has dangerously narrowed margins for legitimate cannabis operators throughout the country.

New Opportunities for Cannabis Research

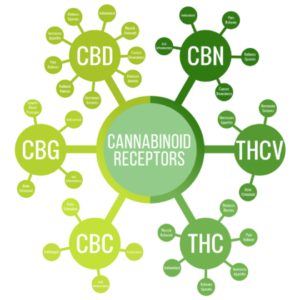

Marijuana’s reclassification as Schedule III would also create new opportunities for cannabis research. At present, cannabis researchers are forced to undergo a complicated series of legal and regulatory authorizations before conducting studies, including registration with the DEA.

By simplifying the process of conducting research and clinical trials on marijuana’s potential health benefits, the rescheduling of marijuana would allow scientists to further investigate new and unexplored therapeutic uses for cannabis, benefiting patients and the cannabis community worldwide.

Criminal Justice Reform

Prioritization of SAFE Banking Act to Follow

And just last week, investors were given cause for further optimism. Not long after the rescheduling suggestion, the Senate announced that they will soon vote on the SAFE Banking Act, which protects financial institutions who partner with cannabis businesses from federal penalties and regulatory scrutiny.

The SAFE Banking Act was created in 2019, and has since passed the House seven times, while gaining enough votes to pass the Senate. However, in previous years, the SAFE Act has been anything but a priority for Congressional leaders, and was most recently rejected in favor of another, newer bill, that proposed to hurt, rather than help, the cannabis industry by raising sales taxes 25% nationwide.

Now, however, it appears that the SAFE Act has finally become a Congressional priority, with lawmakers suggesting that Americans could expect to hear news on its advancement within the next few weeks. According to multiple sources, the SAFE Act will reach the Senate this month, allowing the Senate Banking Committee to vote in favor of legislation that would remove penalties imposed upon companies providing services to legitimate cannabis companies.

Without the SAFE Act, many companies such as Mastercard and Twilio have cut ties with cannabis businesses for fear of regulatory or federal scrutiny, leaving financial analysts to suggest that Visa and other companies would continue to take similar actions until SAFE went into effect.

This has left cannabis businesses desperate to find solutions for banking, communications, and other essential services. But if the SAFE Act is passed, credit card companies and financial institutions will be able to resume industry relationships without the fear of regulatory scrutiny or complications with federal law, restoring access to essential banking services for cannabis businesses nationwide.

What’s Next? A Promising Future, Pending DEA And Senatorial Action

Though the fate of rescheduling and the SAFE Act are now in the hands of the DEA and Senate, this unprecedented progress has instilled optimism throughout the industry.

If these changes take effect, they will allow the industry to thrive and cause stocks to skyrocket. According to Bottomley, if cannabis is in fact rescheduled and the SAFE Banking Act is passed, it will become “more and more likely that institutional capital that otherwise wouldn’t be invested in the space starts entering the space.”

However, the outcome of the DEA’s decision remains essential: whether US cannabis stocks will continue to skyrocket “really depends on, are we going to hear next from the DEA in time? If all goes radio silent into the fall, and then into January, I wouldn’t be surprised for the sector to go sideways,” said Bottomley.

Nonetheless, these developments are unprecedented in scope, and recent news has given businesses and investors a much needed source of hope and confidence in an industry with the potential to thrive, if current regulatory and federal barriers are in fact lifted.